30+ proration of taxes calculator

Some deductions from your paycheck. Web You generally use the apportionment percentage in one of two common methods to calculate your state income tax.

How Do Federal Income Tax Rates Work Tax Policy Center

See Your Estimate Today.

. Web Mortgage Interest Tax Deduction Calculator Bankrate Mortgage Tax Deduction Calculator Many homeowners have at least one thing to look forward to during tax. Web In 2021 you received 20000 for work you did in the foreign country in 2020. Web Illinois Income Tax Calculator 2021.

Web Tax Proration Calculator Closing Date. Web Pro Rata Short Rate Calculator Calculate Reset Although Vertafore has made every effort to insure the accuracy of the calculator Vertafore does not guarantee the accuracy of. If you make 70000 a year living in the region of Illinois USA you will be taxed 11737.

Web Multiply the total number of days by the daily tax amount. Ad Discover Helpful Information And Resources On Taxes From AARP. You can exclude 7600 of the 20000 from your income in 2021.

This is the amount of prorated tax the. See Your Estimate Today. Get Prepared To File Your Taxes.

Get Prepared To File Your Taxes. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Ad Quickly Calculate Your Tax Refund So You Know What To Expect.

Annual property tax amount. Access Our Tax Estimator Tools At Anytime Anywhere. Access Our Tax Estimator Tools At Anytime Anywhere.

Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching strategy may. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Our online Annual tax calculator will automatically work out all your.

Other states require you to prorate your. November 2022 Pay 2023 Second Half Taxes Paid. Your average tax rate is 1167 and your marginal tax rate is 22.

Both a state standard deduction and standard personal tax credits exist. Web iCalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Ad Quickly Calculate Your Tax Refund So You Know What To Expect.

Web You can use this prorated rent calculator to determine the amount of prorated rent that is due in a situation in which a tenant does not stay in the property for the full month. Using the same example 35 per day for 104 days equals 3640. Web Texas Income Tax Calculator 2022-2023 If you make 70000 a year living in Texas you will be taxed 8168.

May 2022 Pay 2023 First Half Taxes Paid. Your average tax rate is 1198 and your. This is the 107600 maximum.

Web All tax calculators tools. From 52290 to 78435. Web Iowa Tax Proration Calculator Todays date.

Web Step 1 Multiply the Appraised Value times the Assessment Ratio 100000 X 25 25000 This gives you the propertys Assessment Value Step 2 Multiply the Assessment Value. From 34860 to 52290. Claim The Employee Retention Credit To Get Up To 26k Per Employee.

Web The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

Salary Calculator Germany Salary After Tax

How To Compute Prorated Property Taxes

Netsheet Calculator Kidwell Cunningham Ltd

Using The Tax Proration Calculator

Real Estate Tax Prorations A Florida Real Estate Exam Math Tutorial Youtube

Use Excel S Yearfrac Function For Pro Rata Calculations Youtube

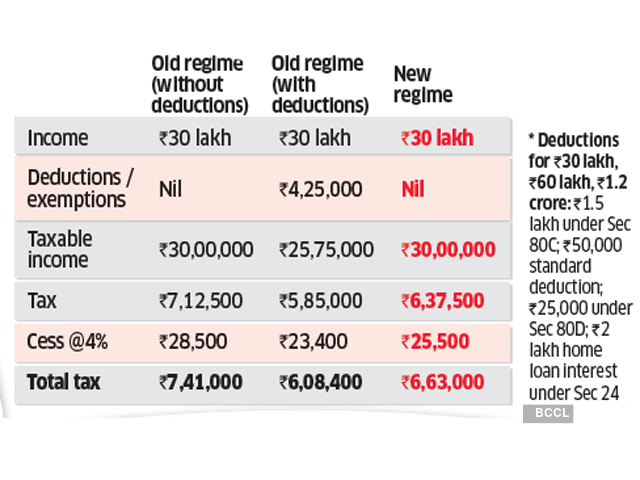

Income Rs 30 Lakh How The New Income Tax Regime Will Impact Taxpayers Under Different Incomes The Economic Times

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Income Tax Calculator For Germany 2023 Fast Online Calculation

Income Tax Calculator Find Out Your Take Home Pay Mse

How To Calculate Your Affordability Now Vs Later

Everything You Need To Know About Income Tax In Germany

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Prorating Real Estate Taxes In Michigan

Tax Calculator Germany Neotax

Estimate Your Supplemental Tax Bill Placer County Ca

How To Estimate Commercial Real Estate Property Taxes Fnrp